Product of the Day

Yoco unveils 50

new updates

During Yoco Next, the fintech revealed new tools aimed at helping SA companies to save time, cut costs, and scale operations.

Yoco, a South African fintech, has announced the release of more than 50 product innovations and updates that address three of the biggest challenges faced by small business owners.

During Yoco Next, an online Digital Product Showcase, the company said it had expanded from origins as the “blue card machine” company to becoming a digital commerce platform used by over 200,000 small businesses in SA.

“For too long, small business owners have faced the impossible choice between running their businesses or growing them,” says Carl Wazen, co-founder of Yoco. “Our expanded ecosystem eliminates this dilemma by giving entrepreneurs the tools to save time, save money, and gain the clarity they need to thrive in today’s challenging economy.”

The challenges addressed include:

1. Reaching more customers

To unlock more revenue opportunities, Yoco has added Google Pay to its online checkout. This enables fast, 1-click payments through websites and social media for the 2.6-million South Africans using Google Pay. It complements Apple Pay, which has been available to Yoco merchants for over a year and has contributed to a more than 10% increase in online payment success rates.

2. Simplifying operations

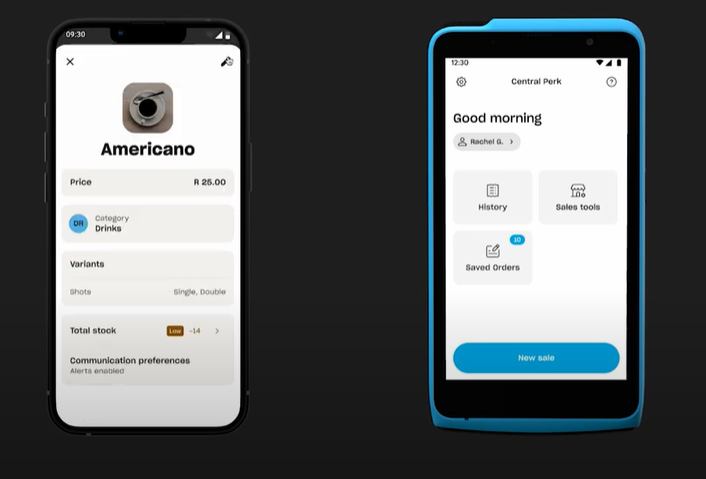

Yoco has upgraded its free point of sale software with powerful new features like saved orders, split payments, and 1-click cash-up, available on its Khumo and Khumo Print card machines.

The company unveiled Yoco Counter – a fully integrated point of sale system that combines a custom-built widescreen tablet, free point of sale software, and Yoco’s Neo Touch card machine. The system enables merchants to personalise their devices with branded screensavers.

Yoco says these features eliminate the need for expensive point of sale hardware software – often costing R10,000 up front and over R600 per month – helping business owners save time and money while improving efficiency.

3. Gaining business clarity

Yoco’s expanded reporting and analytics tools track sales, inventory, and staff performance across multiple locations and platforms from a mobile or web app. The new iOS widgets feature enables merchants to view real-time sales directly from their iPhone lock screen.

“What sets Yoco apart is how seamlessly we integrate payments, point of sale, and cash flow tools,” says Wazen. “We’ve built an intuitive platform where every piece enhances the next, creating a system that grows with our merchants.”

Real impact

Early adopters have seen measurable benefits. Thandi Nkosi, owner of Sunshine Café in Cape Town, says: “Managing payments and inventory used to take me 15–20 hours each month. With Yoco, it’s down to 3-4 hours. That’s more time for customers, and the insights help me make smarter decisions.”

The upgraded Yoco ecosystem is available now and offers flexible solutions for businesses. This release, says Yoco, represents a key step in its long-term vision to become the all-in-one digital commerce platform for small businesses in Africa.