Product of the Day

Visa turns phones into card machines

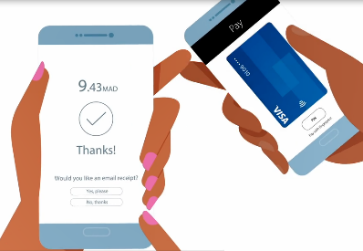

Visa’s new Tap to Phone technology enables NFC-equipped Android devices to accept contactless payments.

As the world increasingly turns to digital payments amid Covid-19, a mobile app can help millions of sellers accept contactless payments, while improving the checkout experience for customers. After piloting Visa Tap to Phone over the past year, Visa today announced product availability in South Africa and accelerated global product growth in the rest of the world via more than 35 new partners, including Visa Ready for Tap to Phone partners.

Tap to Phone allows current-generation Android smartphones or tablets to act as contactless software-based point of sale (soft POS) terminals without additional hardware. This cost-effective tool helps businesses quickly access the digital economy, and improve cash flow by accepting contactless payments anywhere, anytime. Visa says the number of sellers using Tap to Phone has grown by 200% over the past year and is now live in numerous countries across Europe, Middle East, Africa, Asia Pacific, and Latin America.

Recent launches for Tap to Phone include Belarus, Malaysia, Peru, Russia, and South Africa, with upcoming launches planned in Brazil, Italy, and United Kingdom.

“The payments landscape has continued to evolve, as technology advances, to provide consumers with a variety of options,” says Aldo Laubscher, South Africa country manager at Visa. “Card payments’ progression started with the magnetic stripe cards, all the way to the virtual cards and tap-to-phone functionality available today.”

Visa unpacks the opportunity for Tap to Phone by the numbers:

- According to IHS Markit, two billion Android devices globally could transform into payment acceptance machines.

- Tap to Phone holds particular promise for the 180 million micro and small merchants (MSM) around the world, where fewer than 10% of MSMs in many emerging markets currently accept digital payments.

- In a survey conducted by Visa, 63% of MSMs said they would likely implement Tap to Phone in their own businesses and more than 50% of consumers said they would likely use Tap to Phone if offered to them.

“It was just five years ago when Visa set out to enable virtually any IoT or mobile device to make payments and now today, we are enabling many of those same devices to accept payments in a very simple way with Visa Tap to Phone,” says Mary Kay Bowman, global head of buyer and seller solutions, Visa. “With billions of phones around the world at the ready, the opportunity that comes with lighting them up as payment acceptance devices is enormous. Visa Tap to Phone could be one of the most profound ways to reinvent the physical shopping experience.”

Tapping to pay, or contactless payments, is growing rapidly in the Covid-19 era. Visa has seen tap to pay payments grow by 40% year-over-year. In a recent Visa survey, nearly half of consumers (48%) said they would not shop at a store that offers only payment methods requiring contact with a cashier or card reader.

Tap to Phone: How It Works

Sellers download an app, supported by their acquirer, and after registering and selecting their participating bank, the sellers can start accepting contactless payments in just a few minutes. Tap to Phone builds on top of the security of an EMV chip transaction, in which each transaction contains a dynamic cryptogram that cannot be reused. To see more about how Tap to Phone works, a video demonstration is available here.