Africa News

Global music industry booms, led by South Africa

The surge in interest in South African music has gone beyond the previous year’s growth driver, Amapiano, writes ARTHUR GOLDSTUCK.

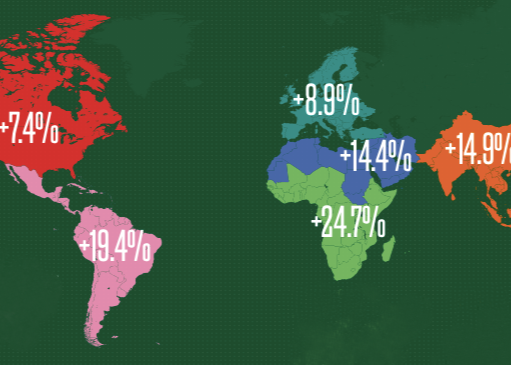

The global music industry reached an all-time high in total revenue last year, driven by massive growth in streaming subscriptions. And, for the second year in a row, Sub-Saharan Africa was the fastest growing region in the world – with South Africa remaining the biggest music market in Africa.

“Growing in value by 10.2% – the second highest growth rate on record – the global recorded music market was worth US$28.6-billion in 2023,” the International Federation of the Phonographic Industry (IFPI) said in its annual report released last week. “In the ninth year of consecutive growth, revenues in 2023 painted a picture of a truly global and diverse industry as revenues rose in every region and across almost every recorded music format.”

Sub-Saharan Africa was the only region to surpass 20% growth: revenues climbed by 24.7%, fuelled by a 24.5% gain in paid streaming revenues.

“South Africa remained the largest market in the region, contributing 77% of regional revenues after growth of 19.9%,” IFPI said.

The surge in interest in South African music has gone beyond the previous year’s growth driver, Amapiano, and is crossing numerous genres.

This comes in the wake of Tyla winning the inaugural Grammy for Best African Music Performance in February for “Water”, an R&B (rhythm and blues) number with a touch of amapiano. Last year saw a Grammy win for Wouter Kellerman , Zakes Bantwini and Nomcebo Zikode for Best Global Music Performance. In 2022, Black Coffee took the Grammy for Best Dance/Electronic Album.

Tyla’s Grammy is the 11th to be won by a South African act, underlining the global impact of music emerging from Africa.

Simon Robson, international president of Warner Music, said: “What is so exciting about Africa is that the music itself – from a variety of genres – just seems to be something which transcends national or global barriers. The market itself is still coming from a low base but is showing strong growth. So there’s an element of helping those internal markets to continue to strengthen and become more material and meanwhile, the export potential of African music is huge.”

Christel Kayibi, director of repertoire strategy at Sony Music Africa, says a rich blend of genres and cultures is driving growth and creativity: “The growth across various African genres is the highlight for me. I always wanted there to be more to African music across the world than just Afrobeats.

“Obviously Amapiano is becoming well-established on a global stage, but there are other artists and genres ready to step into the spotlight. We need to ensure that artist development and building sustainable careers – in Africa and overseas, remains an important part of our toolkit. That’s the name of the game for all record companies.”

Tunji Balogun, chairman and CEO of Def Jam Recordings, says the label has a very deliberate strategy to engage and drive developments in the region by forging partnerships:

“When it comes to music coming out of Sub-Saharan Africa, we’ve partnered with a label from Nigeria called Native,” he says. “They really spoke directly to this community of Gen Z African kids. I met them probably four or five years ago, and I felt strongly that I wanted to work with people that have genuine connection to the culture on the continent.

“We decided to do a joint venture. We signed an artist, Odumodublvck, a rapper from Nigeria and last year he was the biggest new artist, I would say, on the continent.”

Balogun says the nature of the partnership meant the rapper was able to connect with a US audience.

“He’s done really, really well. He actually did his first show in the States, to a packed room. Everybody knew all the words. Just seeing it go from a movement in Nigeria to now like ‘I’m at the Peppermint Club in LA’, and there are kids singing along to a rapper who’s never performed here before. Things like that exemplify what we should be doing.”

Tyla, who released her eponymous debut album last week, broke through last year with the hit single “Water”, which racked up 500-million streams on Spotify. However, she was already making waves before that, according to the streaming service.

Her top streams on Spotify before the release of “Water” came from Nairobi, Lagos, Johannesburg and Cape Town. Now, Sydney, Melbourne and Jakarta are the cities most active in streaming her music, with Amsterdam showing a strong following both before and after the release. Water saw a 30,000% increase in her average daily streams, and her tracks have been added to 10-million Spotify playlists.

The new album is expected to intensify the demand for her music.

Jodie Tabisher, Spotify artist , label and partnerships manager for South Africa, says: “The fact that four of the songs from this album are already in Tyla’s top streamed tracks showcases her immense talent.”

Cat Kreidich, president of ADA Worldwide, an independent distribution and label services arm of Warner Music Group, says independent artists now have global opportunities: “The modern music business is truly global, and that’s really exciting for independent artists. We break artists who come from anywhere and the start of their breakthrough can ignite anywhere – you don’t have to have a hit in the US to spark interest in the US, because every territory is looking at what every other territory is doing. We will pick up on a success story happening anywhere in the world and translate it everywhere.”

Tyla’s breakthrough underlines the extent to which streaming music has become critical to artist success.

Streaming revenues accounted for the majority of global revenue growth and total market share last year. According to IFPI, subscription streaming alone grew by 11.2% and comprised 48.9% of the global market. Nevertheless, physical music continued its comeback last year. CDs and vinyl albums clawed their way back into contention with a strong double-digit percentage increase – up by 13.4%, to reach $5.1-billion, after a low of $3.7-billion in 2020.

Felix Richter, analyst at Statista, says the transition to digital distribution has both fuelled the music industry’s decline and helped stop it.

“After the golden age of the CD, which propelled worldwide music revenues to unprecedented highs through the 1990s, the advent of MP3 and filesharing hit the music industry like an earthquake,” he says. “Between 2001 and 2010, physical music sales declined by more than 60%, wiping out $14-billion in annual revenue.

“During the same period, digital music sales grew from zero to $4-billion, which wasn’t even remotely enough to offset the drop in CD sales. It wasn’t until the appearance and widespread adoption of music streaming services that the music industry’s fortunes began turning around again.”

According to IFPI, 667-million people were using a paid music streaming subscription by the end of 2023.