Fintech

When banks go beyond banking

FNB’s introduction of lifestyle solutions like education and security reveal that banking is no longer about just a bank account, writes ARTHUR GOLDSTUCK

The FNB banking app may still have bank accounts at its core, but users logging on from this week will discover a dramatic shift in what was once known, simply, as “banking”.

On Monday, the bank unveiled a range of lifestyle solutions “designed to help its customers beyond financial services”, taking it into the realms of education, private security and gaming.

The new offering includes:

- Starbucks: Complimentary coffee weekly.

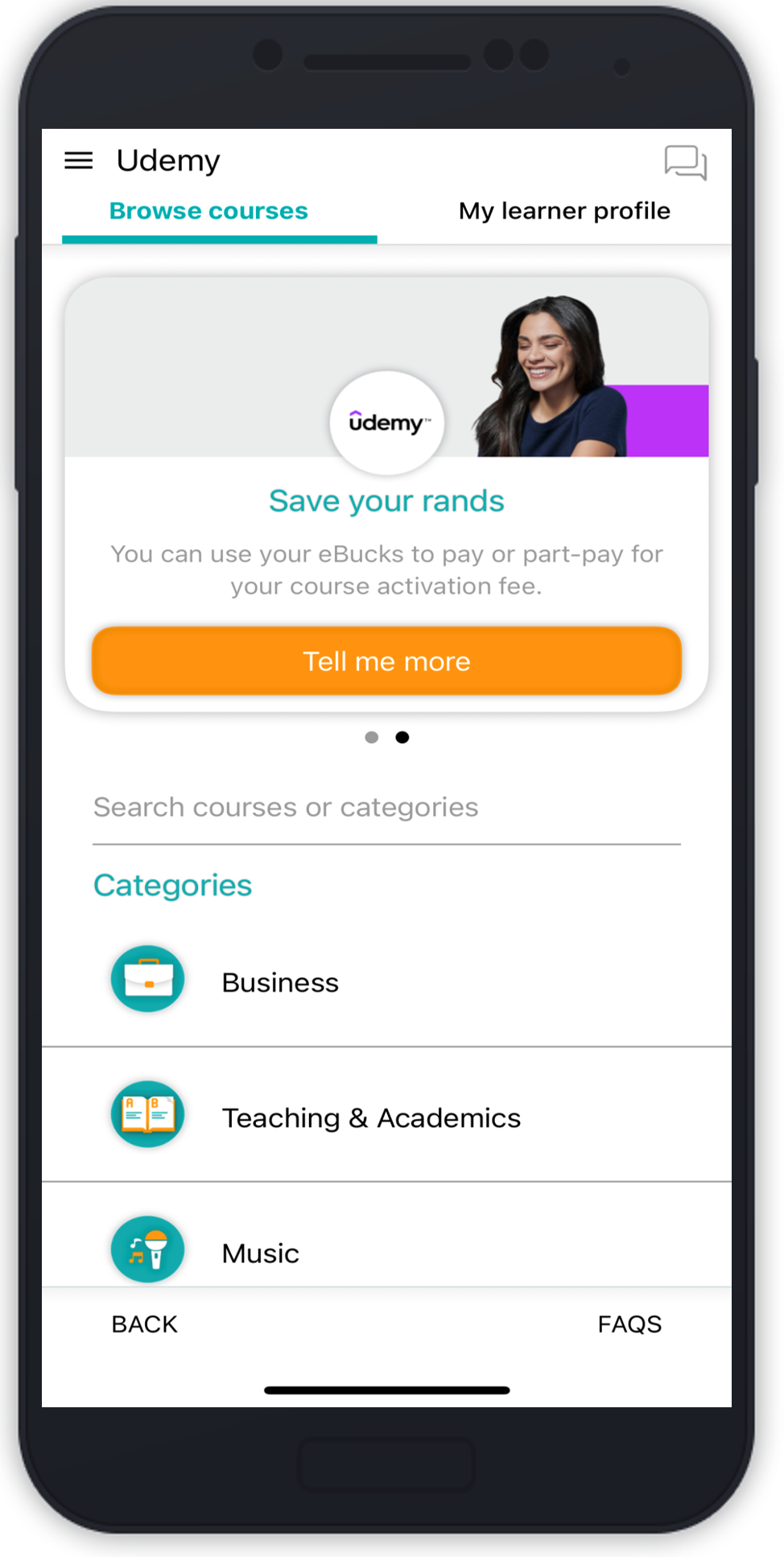

- Udemy: affordable access to online courses.

- GuardMe: medical and personal armed response service.

- eBucks Games: ad-free games with no monthly subscription.

- FNB Connect deals: High end smartphones, laptops and iPads from Apple, Samsung and Lenovo at a lower price than from retail stores.

- Slow Lounge: FNB announced the official acquisition of airport Slow Lounges.

The FNB Connect deals are described as “Hero Deals”, representing high-end devices that tech brands tend to refer to as “hero” models. Thes deals include:

- R89 per month for a Lenovo M10 tablet, including earphones & cover (total fee of R2,136 vs. R3,999 cash price).

- Apple iPad 9 10.2” at R199 per month (total fee of R4,776 vs. R6,499 cash price).

- Lenovo IdeaPad 3 at R279 + backpack, mouse, and Office 365 (total fee of R6,696 vs R9,999 cash price).

The acquisition of the Slow Lounge Business has received regulatory approval, and FNB and RMB Private Bank customers will now continue to get access to the facilities that have changed the flying experience in South Africa, at OR Tambo, Lanseria, King Shaka, and Cape Town International airports.

“This is a major step-change in our efforts to be relevant to customers in every context,” says CEO Jacques Celliers. “The lifestyle solutions we are integrating into our ecosystem will set new standards for value-added services in the financial services industry.”

We asked Celliers what the motivation was for moving so aggressively into lifestyle options.

“We have the privilege of having a tremendous amount of activity that we attract the consequence of our banking relationship,” he said. “Our expanded value propositions to insurance and investments are really gaining a lot of traction. We found over time that the further opportunity to extend those interactions is a very exciting agenda for us. We built out what we refer to loosely as lifestyle offers, as additional reasons why people choose our platform.

“In today’s world, there’s a lot of frustration with people having to go to different environments for this and that. For example, one that we’ve attracted a tremendous amount of attention on over the years is the ability to have topped up airtime or electricity or water, the day-to-day needs that people have as it relates to lifestyle, and just getting by. Over time we’ve expanded that and those expanded opportunities give us further traction and out of those interactions, we create more stickiness.

“If we can retain clients more and have more regular interactions, we can create more activity. That’s typical of platform business models.

“The second one: it’s easier for you to start a new relationship with someone when you can help them with small things here and there. We give people license renewals and we do airtime top-up, we can help you with a plane ticket or travel … and then be more contextual with our finance service offering.”

A key question is whether the expanded service offering is a response to banks like Nedbank and telcos like Vodacom launching “super apps”. But that was not Celliers’ vision.

“We don’t use the word super app. We think it’s a bit of a sort of a marketing gimmick. In theory, a banking value proposition is a very big privilege to have with a client, especially as it relates to that primary banking relationship. That privilege mustn’t be taken for granted. So we sweat, creating value for the clients. So we can give them solutions, making banking and your investments, your financial solutions, much more holistic, and we can catch you at whatever contextual moment you are.

“Are you starting off in life or are you retiring or, buying the neighbour’s farm, expanding your business, starting your business? Those are all contextual. So we look for inspiration from what the world is providing customers.