Commerce

Virtual cards redefine Black Friday

The annual shopping craziness of the Black Friday weekend (of which Cyber Monday has become an integral part of) is here. Already, many retailers have begun promoting incredible specials. But it’s one thing buying that big screen TV you’ve been eyeing all year when it’s available at half price, and something else entirely to do so safely without falling victim to an online scam.

For more than a year, we’ve all been encouraged to shop online. Whether it’s for our weekly groceries, clothes, or high value items (we really like that TV), the focus has been on pointing and clicking to avoid standing in line and being exposed to that dreaded virus which shall not be named.

In fact, according to research by World Wide Worx such has been the collective shift of us buying online that e-commerce sales grew by a staggering 66% last year to top R30-billion. So, if there’s one good thing to be said of the lockdown then it’s how those sitting on the e-tailing fence have finally made the leap of faith.

But with all the convenience that online shopping has provided, and let’s not forget about being able to access a staggering amount of Black Friday deals from anywhere in the world, there is still concern about the rise in fraudsters. They’re discovering more creative ways to wreak havoc on our lives as the technology available to them becomes more advanced.

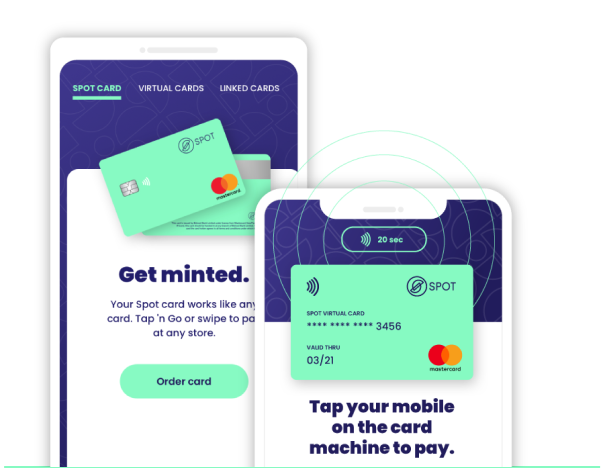

One way to address this challenge is through a virtual card such as the one offered through Spot Money. It comes with a host of security features designed to keep the online shopping experience as safe as possible.

“Think of a virtual card as just another card. The difference is that the card number is not the same one you can find on your primary physical card. You can top up your virtual card with the amount needed for the purchase, meaning, if your card details were compromised, hackers wouldn’t have access to your full bank balance. Freezing your virtual card is as easy as tapping the option in the Spot Money app. No need to rush to a bank or cancel your real card,” says Andre Hugo, CEO of Spot Money.

The Spot Virtual Card provides users with an additional layer of defence between one’s actual card number and those hackers looking to make merry with hard-earned funds.

The potential of virtual cards in a developing market like South Africa is significant. Deloitte believes that the payment ecosystem in the country must evolve to address the needs and solve the pain points of consumers. These include having a payment solution to pay anywhere, rather than across multiple applications. In this light, virtual cards do provide a platform for innovation to meet this challenge.

Beyond the benefits already mentioned, virtual cards also offer consumers the following options:

- Control spending. A person can easily set the limit of each virtual card according to their requirements.

- Convenience. Unlike traditional cards that must be collected at a branch or delivered, virtual cards can be created as needed and immediately available for use.

- Customisation. A user can create a virtual card for each online store they use, freeze the card when they are not shopping, and unfreeze it to take advantage of any specials.

For more info on how to use a Spot Virtual Card, click here.