Connectivity

MWC 2024: MTN makes waves

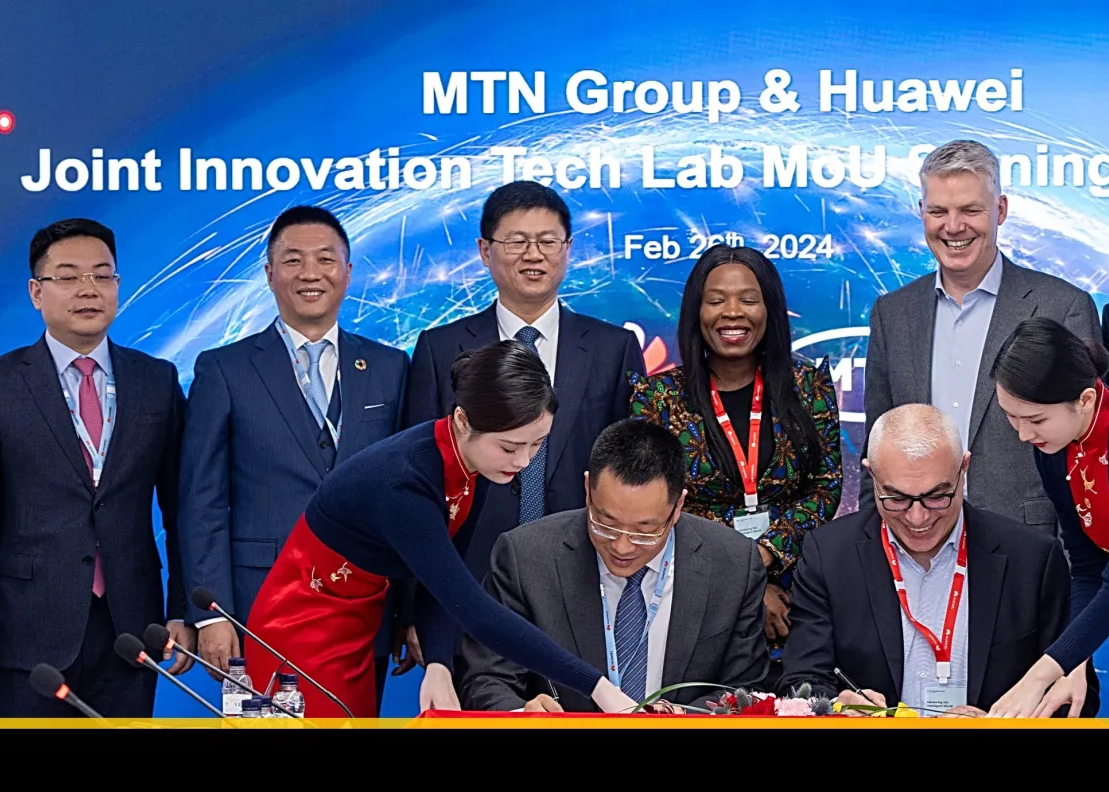

Deals with Mastercard, Huawei and Ericsson consolidated the South African operator’s brand on the world map, writes ARTHUR GOLDSTUCK.

It is always startling when South African brands leap out from presentations at international conferences. Typically, this happens when global organisations parade their “logos” – conference-speak for the brands they are able to show off. Several South African logos make repeat appearances in these showcases, and it’s not unusual to see the likes of Standard Bank, Absa and FNB sporadically featured.

However, at last week’s Mobile World Congress 2024 in Barcelona, the world’s biggest telecommunications event, one brand came up again and again. MTN not only made it as a logo for major global players, however, but also made waves in its own right with a series of news-making announcements.

Two of these were related to its core telecoms business. First, it signed an agreement with Huawei to create a Joint Innovation Technology Lab at MTN Group’s headquarters in South Africa.

MTN said it “will leverage this initiative to focus their research and development efforts on key areas such as 5G and beyond, artificial intelligence, big data analytics, cloud computing, and digital financial services”. It would address unique challenges faced in Africa, including improving network coverage in rural areas, enhancing energy efficiency, and affordability.

Huawei corporate senior vice president Li Peng said: “Huawei will continue innovating with MTN to ensure they have the products and solutions required to best serve Africa’s unique market. This will not only give MTN a competitive edge in terms of network quality, user experience, and rapid deployment, but also help MTN achieve their own business objectives.”

MTN also announced new developments in its partnership with Ericsson, a competitor to Huawei in telecoms infrastructure, to modernise its core network in South Africa and Nigeria.

Arguably it’s biggest announcement came in the wake of an investment earlier in February by Mastercard of $200-million for a minority share in the MTN Group Fintech division. At MWC on Wednesday, the two unveiled a prepaid virtual card for MTN’s Mobile Money (MoMo) users, giving them access to over 100-million acceptance points worldwide. It would also allow MoMo merchants to accept card payments, enhancing cross-border money remittance services.

Amnah Ajmal, Mastercard executive vice president for market development in the EEMEA region, told Gadget at MWC that the agreement would cover 13 countries in Africa.

“What MTN brings to this partnership is their massive consumer base and Small and Medium Enterprise (SME) merchants, together with the trust and the data of the consumer. Add to it Mastercard’s capabilities around acceptance solutions, where a merchant’s device becomes an acceptance point of sale, or capabilities like virtual card solutions. Those kinds of synergies offer massive opportunity to drive financial inclusion and innovation in Africa.”

Three distinct opportunities have been opened up by the agreement.

“Every consumer who has a mobile wallet today, which is an MTN wallet, will be issued a digital card. And with this, the whole world of ecommerce and regular commerce opens up for these consumers.

“Second is the SME lens. The SME is the backbone of any market, but more so in Africa, and the majority lack access to financial services. A farmer who’s selling oranges can never have access to financial services, if he is not in the digital world. So equipping them with an acceptance device brings them into the ecosystem of financial services, and all the payments and transactions are on record.

“The last part is remittances. Africa is huge when it comes to outbound and inbound remittances. There are $2-billion in daily transactions taking place, and this is almost 40% of the GDP of the entire sub Sahara Africa. Remittances on mobile money wallets are growing 65% year on year and people are looking for affordable ways to send money back home.”

* Arthur Goldstuck is founder of World Wide Worx and editor-in-chief of Gadget.co.za. Follow him on Twitter and Instagram on @art2gee