News

How Russia-Ukraine conflict disrupts supply chains in SA

Russia’s invasion of Ukraine impacts supply chains in South Africa, ultimately affecting households and businesses across the country.

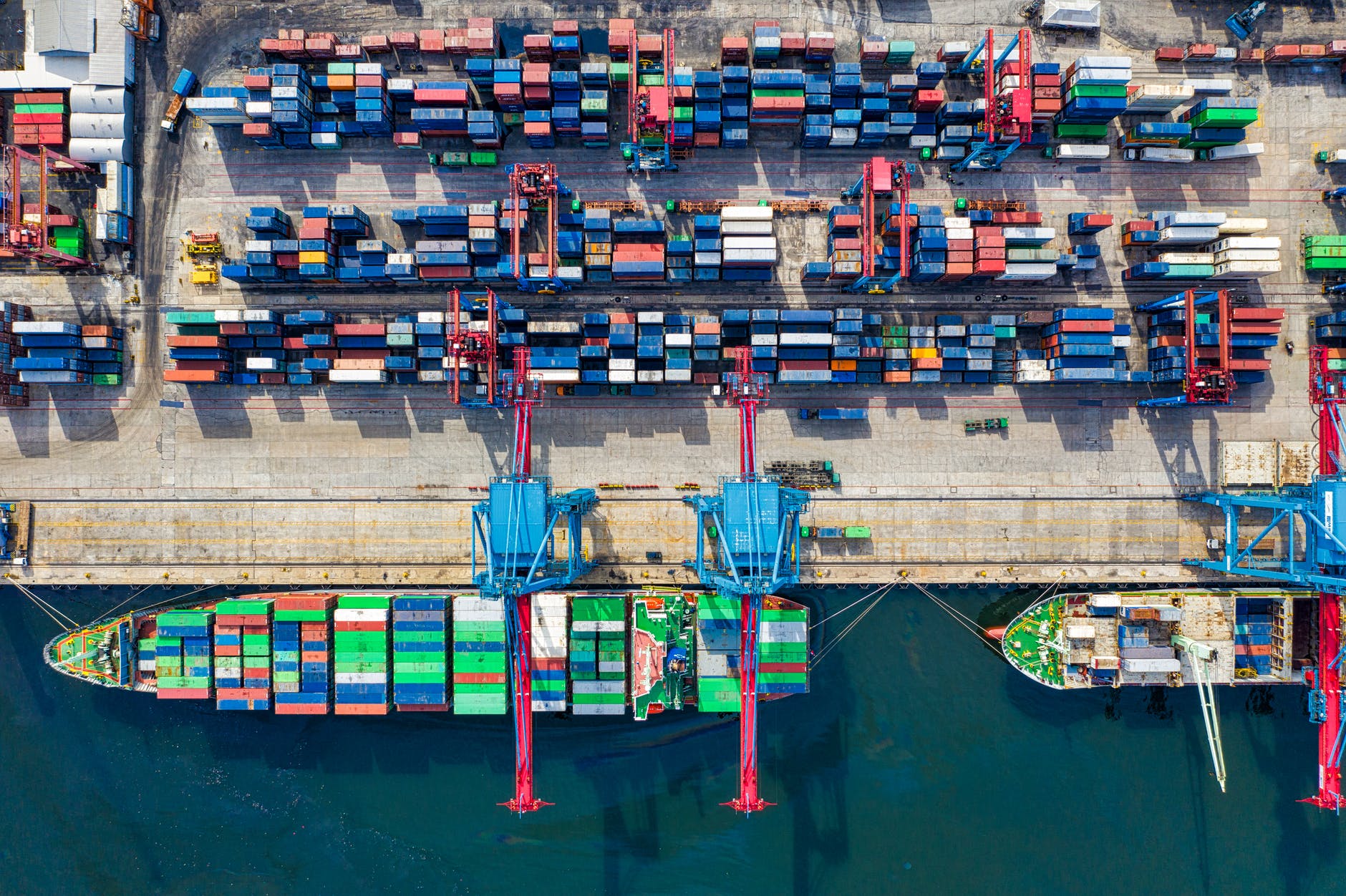

In the globalised economy we find ourselves in today, local economic growth in one country is hampered or driven by activities in the global market and South Africa is no exception to this. Globally, the economy took a sharp plunge induced by the Covid-19 pandemic in 2020, which resulted in soaring inflation levels, reduced employment levels, amplified semiconductor shortages, and acute supply chain disruptions. Global and local lockdowns had several knock-on effects on the distribution of raw materials and finished products from suppliers to the market as the land, sea, and air freight shipping routes were halted.

The impact was highly felt in industries like the food and manufacturing sectors, with the South African manufacturing sector mimicking the global sector’s growth reduction trend. Locally, the manufacturing sector’s growth was further hampered by the July riots in 2021 that saw the destruction of properties (warehouses, factories) and products. Now, two years into the pandemic, global and local forecasts still predict the persistence of supply chain disruptions through 2022 and early 2023, with optimistic views set for the second half of 2023.

The early 2022 signs of slow recovery in manufacturing, which were in part being driven by improvements in production in Europe and Asia (excluding Japan), according to a survey done by IHS Markit may now be threatened by the rising geopolitical tension in Europe, with the Russia-Ukraine conflict and a resurgence of the Covid-19 virus in China. However, pockets of opportunity exist for markets that can fill the gaps in exports from Russia.

Prior to the invasion, global GDP growth forecasts for 2022 were above 5% (based on September 2021 Frost & Sullivan analysis), while the global manufacturing Purchasing Manager’s Index (PMI) also showed some signs of resilience and recovery in the global economy in the face the Omicron variant and looming new Covid-19 waves. The PMI data registered a 0.4 high (53.6) in February of 2022, from the 53.2 recorded in January but still shows below pre-pandemic averages, with an overall modest annual growth rate of just under 2% for global production.

Following the recent Russian military presence in Ukraine from 24 February, several western markets imposed sanctions on exported Russian commodities and key input materials, actions which are expected to have ripple effects on the global economy. Some effects will include a continued shortage of semiconductors and raw materials (grains, oilseed), staff decline in Ukraine’s employment sector, and rising input prices (i.e., fuel). With predictions of global GDP growth expected to drop (down to 4.3% by Frost & Sullivan), it is worthwhile tracking the possible implications on the supply chain and growth opportunities this presents for South African industries like the food and automotive sectors.

Automotive/Electrical Manufacturing Sector: Dependence on Russia and Possible Growth Opportunities

Russia and South Africa are two important players for platinum group metals (platinum, palladium, rhodium) global production and exports, with the demand being mainly driven by three sectors automotive, industrial (electrical and chemicals) and jewellery. Russia leads in palladium production recording 98 and 91 metric tons in 2019 and 2020, respectively (Figure 1a) while South Africa is a key player for platinum (71% in 2019) and rhodium (~83% in 2021). These two markets are closely followed by North America and Zimbabwe. Thus, any negative activity in one of these countries has potential impacts on the global commodity prices and the overall supply of these metals.

With the rise in platinum prices over the past decade, the demand for palladium has experienced growth as it is being used a substitution metal in light-duty diesel vehicles in Europe which accounts for 20% of global demand. The demand for palladium was further driven by the growing Chinese motor vehicle market. The current war in Ukraine has caused logistics bottlenecks in Russia and Ukraine and drew US sanctions on Russia which drove fuel prices. Together these developments stand to impact manufacturing value chains for both automotive and electrical products but has opportunities for alternative exporting markets like South Africa.

In 2020, South Africa accounted for 33% of the global palladium mine production (Figure 1a) and was the fourth-largest exporter thus it can benefit from the present crisis by filling this demand-supply gap, through increased exports from the country. As the overall prices for palladium prices currently have not been drastically impacted, dipping to just under 1,100 U.S. dollars per troy ounce on 10 March, (down by some 6.5 U.S. dollars day-over-day), revenue generated from filling this gap will be large. South Africa and Zimbabwe would benefit even greater if increased focus is placed on more value-add downstream beneficiation opportunities prior to export. Currently, both the United Kingdom and the United States benefit in export revenue from re-exports of palladium powder from Africa.

Food Sector: Dependence on Russia-Ukraine and Possible Growth Opportunities

The food sector in South Africa will only see impacts from the war through possible price increases rather than shortages. These increases which may be gradually felt 3 to 6 months from now, according to Grain SA can be cushioned with collective efforts by the government and private sector as they will have severe implications on the low-income groups. Russia and Ukraine collectively account for more than a quarter of the world’s wheat exports and are the leading markets for sunflower oil exports, which are key raw materials for the production of staple food, worldwide. Thus, the current state of things in the two countries is predicted to result in a reduction in global production which will impact global wheat prices.

In 2020, Russian exports to Africa were worth USD 3.63bn, followed by France at USD 2.16bn and Ukraine at USD 1.45bn, but little of this was destined for South Africa, whose trade partners are mainly Argentina and Brazil. However, as wheat prices are controlled by changes in the international market, South Africa’s high import status for wheat is the main concern. The present crisis echoes once again the need for raising local production by supporting local producers in the coming months. In the past decade, local production suffered at least 5 significant dips (Figure 2a) which were mainly caused by increases in global wheat prices, a weaker rand, increased domestic consumption along with climatic factors such as below-average rainfall, more to soften the dips. One support stream highlighted by several economists is around cushioning fuel prices (input costs) and protecting the exchange rate.

Conclusion

In conclusion, the Russia-Ukraine turbulence will have a gradual impact on South Africa’s food and manufacturing sector, which will be gradually felt by businesses and households in the upcoming months. However, it is not all gloom as the situation presents pockets of short-term growth opportunities for South Africa, for metal exports (i.e., palladium) particularly if value-add downstream beneficiation opportunities are explored, but also highlights the need to promote the local agricultural production sector to cushion the economy from such changes in future.

Currently, uncertainty lies on the extent of the impact, but several adjustments have been made on global GDP growth predictions, but the upcoming months call for collaborative efforts from the government (particularly for fuel prices) and businesses to protect South Africa’s economy and its inhabitants.