Product of the Day

Faster onboarding supports payment security

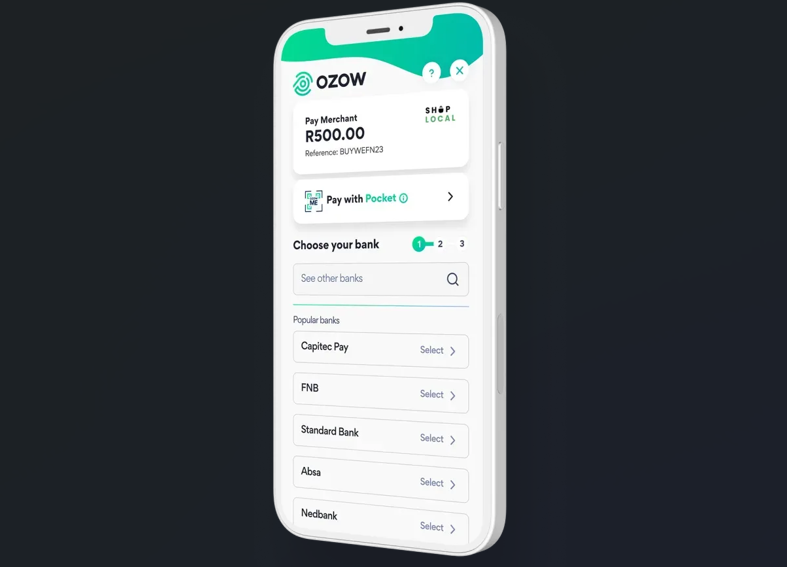

Ozow and RelyComply aim to reduce fraud by applying AI-based compliance checks earlier in the payment process.

High-risk profiles can now be detected earlier during merchant sign-up within fintech Ozow’s payment network, helping to create a cleaner and safer payments environment. This follows the direct embedding of AI verification tools from the regulatory tech company RelyComply into the Ozow’s onboarding process.

South Africa’s payment landscape has undergone significant changes. According to the companies, account-to-account, mobile, and voucher payments are now an integral part of everyday life. However, with increased digital activity comes an increased opportunity for fraud, from fake identities and mule accounts to bogus business registrations.

As digital payments continue to grow, onboarding has become a critical control point for payment providers. Verifying merchants accurately at the outset helps limit exposure to financial crime while ensuring legitimate businesses are not delayed by overly complex checks. In a competitive payments environment, the ability to onboard quickly while maintaining regulatory standards is increasingly important.

“Onboarding is where trust begins,” says RelyComply CEO Bradley Elliott. “As payment systems grow, that trust needs to scale too. Our partnership with Ozow reflects a shared belief – that secure growth starts with smarter compliance.”

The integration of AI-driven verification tools is intended to automate key compliance steps within the onboarding workflow. By reducing reliance on manual checks, the process can become more consistent and efficient, while still identifying potential risks early. This approach allows payment platforms to scale their operations without compromising on regulatory requirements.

Inclusive and secure

The partnership supports Ozow’s mission to make digital payments simple, safe, and more accessible for all South Africans. Strengthening compliance measures helps build confidence among both merchants and consumers, particularly as digital transactions become a routine part of daily commerce.

Improved onboarding controls play a role in protecting the wider payments ecosystem. Preventing fraudulent actors from entering payment networks reduces downstream risks, supports regulatory obligations, and contributes to greater overall system stability.

“We’re excited to partner with RelyComply to enhance the safety and reliability of our merchant onboarding process,” says Ozow interim CEO Rachel Cowan. “As we grow, we remain focused on helping people and businesses transact with confidence.”

The collaboration reflects a broader trend in the fintech sector, with payment providers increasingly turning to specialised regulatory technology to address evolving fraud and compliance challenges while supporting growth.