GadgetWheels

Horses for courses, cars for countries

Acceptance and use cases for self-driving vehicles differ greatly among major automotive markets, a global survey finds.

In November 2022, the Japanese technology company Asahi Kasei and the Cologne-based market research institute SKOPOS conducted their fourth “Automotive Interior Survey” in the four most important automotive markets: Germany, China, the USA and Japan. 1,000 vehicle users with different income levels in each market answered questions about their purchasing behavior, understanding of automotive sustainability, as well as acceptance and usage scenarios for autonomous vehicles.

Brand loyalty globally continues to decrease

The results of the survey show respondents in all four regions prefer to own a car also in the future. One in two respondents in Germany and the U.S. can imagine purchasing a new car; this proportion is significantly higher in China (79%) and Japan (62%). In contrast, not owning a car or using car-sharing services only is not yet an option for respondents in Germany (11%), the USA (3%) and Japan (4%).

In Germany, the USA and Japan, as in recent years, one in two vehicle users would choose a model from another brand when buying their next car. In China, 82% of the respondents would choose a car from another manufacturer. By comparison, in 2020 only 41% could imagine switching brands. The rapidly growing range of domestic brands in the world’s largest car market will further intensify the competition for customers’ Favour in the coming years. In addition, the differentiation via price, drivetrain technology, as well as interior equipment and functions is becoming increasingly important.

Michael Franchy, Director of North American Mobility for Asahi Kasei America states “to address this challenge, OEMs need to partner with suppliers, who have expertise across interior, exterior and electrification, which will allow them to shorten development times and bring features and functions to market quicker.”

Range and charging times are key when buying electric cars

58% of the respondents in China would consider buying a purely battery-powered electric car. In Germany, only 29% choose this option, in the USA (21%) and Japan (18%). Among potential EV buyers in all regions, range and charging time are important factors in the purchase decision. 39% of the potential EV buyers in Germany also look at the CO2 emissions during vehicle production. This shows the issue of sustainability is becoming more important and more complex in the purchasing decision process.

The understanding of sustainability is changing

Even with the transformation to a zero-emission vehicle the mission of achieving “sustainable mobility” is far from complete. The survey results show a “sustainable vehicle” is no longer just defined by the drivetrain technology, but also by the CO2 footprint in production, easily recyclable materials, or even the decarbonisation of vehicle manufacturers and their suppliers. In short, sustainability and transparency along the entire value chain are also playing an increasingly prominent role from the customer’s perspective.

Heiko Rother, General Manager, Business Development Automotive at Asahi Kasei Europe comments: “The topic of sustainability is becoming increasingly complex and poses enormous challenges for the automotive industry. With our expertise in green hydrogen, CO2- and bio-based materials as well as the use of recyclates and recycling technologies, we want to achieve the goal of sustainable mobility together with our partners.”

Big regional differences in acceptance for fully autonomous vehicles

In the new survey, Asahi Kasei placed a special focus on the topic of autonomous driving. The results show that in Germany and the U.S. more than one in two respondents currently rejects the use of fully autonomous cars. In Asia, on the other hand, survey participants are much more open to the new technology: In China, only 10% of all respondents are against its use, in Japan 22%. In both countries, one in two respondents can even imagine buying a fully autonomous vehicle. Chinese manufacturers have caught up rapidly in electromobility in recent years. The customers’ affinity for new technologies favors rapid market penetration of innovations and might contribute to China taking a leading role in the field of “autonomous driving” as well.

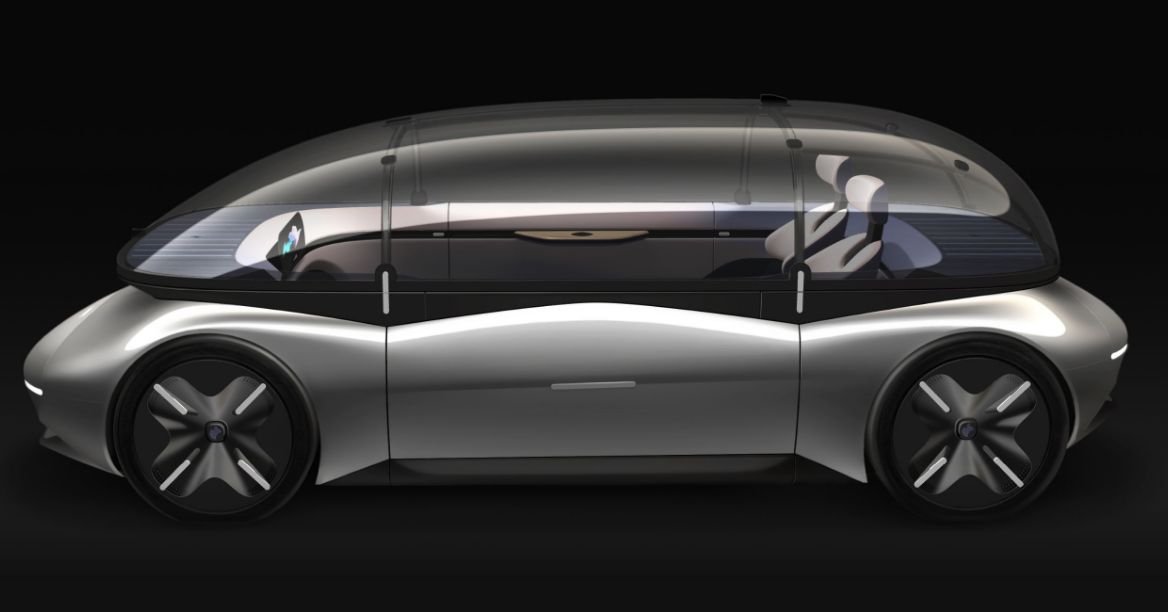

There are also major differences among the markets with regard to the usage scenarios of fully autonomous vehicles. Displaying tourist information and reading/relaxing are highly popular among respondents in all regions, regardless of the type of vehicle ownership. About one in two car users in China would watch movies and series, in Japan only one in four. In a shared autonomous vehicle, one in two respondents in Japan would spend time sleeping, while only one in seven would work in the car. These different usage scenarios also give rise to new needs in terms of interior design.

As is already the case with conventional vehicles, easy-to-clean textiles and surfaces as well as easily adjustable seats are very important to respondents in all regions and regardless of the type of ownership of fully autonomous cars. Individualised interior lighting and a function for darkening the windows help with reading and relaxing. Fully rotating seats, on the other hand, play only a minor role, particularly in Germany, the USA and Japan.

Even in fully autonomous vehicles, a large proportion of vehicle users in Germany, the USA and China prefer to have a steering wheel and brake pedal for optional manual control – in Japan, one in two would. In Germany and the USA in particular, this option can help increase acceptance of autonomous vehicles.

Rother concludes: “Individual mobility and the car will continue to play a key role in people’s lives worldwide. Preferences in terms of usage scenarios and equipment indicate what the interior of increasingly autonomous vehicles may look like. This makes it more crucial than ever to focus on the customer, their wishes and the driving experience when developing new materials and technologies.”