Product of the Day

Ozow integrates PayShap Request for instant pay

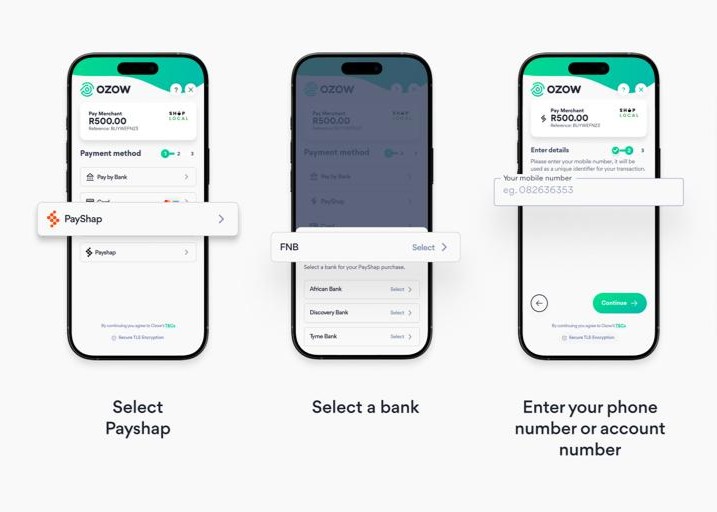

The new feature lets merchants receive secure payments while customers pay using a ShapID or bank account number.

South African payment processing platform Ozow has integrated PayShap Request. The real-time payment feature works for customers with a ShapID registered at their bank, while those without one can use their account number. It does not require an app, card, or login.

The PayShap ecosystem has processed over R100-billion across 136-million transactions, with more than 4.5-million ShapIDs registered. The integration enables merchants to tap into a fast-expanding network, without requiring customers to pre-register a ShapID.

Recent insights from the South African Reserve Bank (SARB) underscore the need for greater collaboration and modernisation across SA’s payments ecosystem. The implementation directly responds to these calls, offering a fast, secure, and user-centric service that aligns with the SARB’s Payments Ecosystem Modernisation (PEM) programme.

The integration aligns with current trends in the SA fintech and payments landscape, which emphasise instant payments, enhanced security, and broader financial accessibility.

The SARB’s Rapid Payments Programme (RPP), of which PayShap Request is a principal component, aims to transform the national payments ecosystem by driving digital adoption and ensuring more inclusive financial services for all South Africans.

“We are incredibly proud to be at the forefront of enabling PayShap Request for South African merchants,” says Rachel Cowan, interim CEO of Ozow.

“This launch truly demonstrates our commitment to innovation and our dedication to providing businesses with the most efficient and user-friendly payment solutions. By being among the first to bring PayShap Request to a live environment, we are not only offering a significant competitive edge to our merchants but also helping deliver on the SARB’s mandate for a modern, inclusive payments future.”

Enhanced customer experience and accessibility

Ozow’s PayShap Request offering is designed to improve accessibility and ease of use by removing the requirement for a pre-registered ShapID. Customers who have not registered a ShapID, which links a phone number to a bank account, can instead use their bank account number to complete transactions.

At checkout, customers select PayShap, choose their bank, enter either their phone number or account number, and then authenticate the payment through their banking app. This approach reduces friction in the payment process and supports broader participation in the digital economy, aligning with the SARB’s efforts to advance financial inclusion.

Key benefits for merchants and consumers, provided by Ozow:

- Instant payments: Merchants can get paid in real-time, significantly improving cash flow and speeding up service delivery.

- Customer convenience: Customers can make instant payments using just their mobile number or bank account number.

- Access to new customers: With over 4.5-million ShapIDs registered, PayShap opens access to digitally hesitant and risk-averse consumers, expanding the potential customer base for merchants.

- Secure and irrevocable: Every PayShap payment is authenticated directly via the customer’s banking app, with built-in fraud prevention mechanisms, ensuring secure and irrevocable transactions.

- Direct refunds: Merchants can easily process refunds directly into a customer’s bank account.

- No extra setup required: Merchants already integrated with Ozow can enable PayShap Request with no additional development needed, ensuring a seamless transition and immediate benefits.

Cowan says: “Account-to-account payments have been central to Ozow’s model from the start, and with PayShap enabling deeper integration between banks and fintechs, we’re one step closer to a more interoperable payment ecosystem.”