Software

Signpost: WhatsApp Commerce is coming for your wallet

What began as an informal backchannel for orders and service is about to turn WhatsApp into the point-of-sale itself, writes ARTHUR GOLDSTUCK.

Most South Africans already run their businesses on WhatsApp. A hair salon takes bookings through voice notes. A courier firm shares delivery updates using photo messages. A restaurant sends out its weekly menu via broadcast. What began as an informal backchannel for orders and service has become the country’s most entrenched digital business tool.

The next leap forward will turn WhatsApp into the point-of-sale itself.

For Sukhiba, a company founded in 2022, this leap has already happened. Active in 15 countries across Africa, the Middle East and India, it enables full transactions to happen entirely within WhatsApp.

“WhatsApp is the default operating system,” says co-founder and CEO Ananth Gudipati, talking to Gadget from Nairobi this week. “Most customers prefer to talk on WhatsApp to the shop, whether buying a product or enquiring about deliveries.”

Sukhiba’s goal was never to change consumer behaviour. Instead, it chose to bring the entire e-commerce infrastructure, from ordering to payment to fulfilment, into the app where customers already spend their time.

“If customers are on WhatsApp, why try bringing them to mobile apps and websites?” Gudipati asks. “When we were running ecommerce previously, we learned that WhatsApp is actually a major trust builder, but there’s a lot of friction. Why not bring all the infrastructure to WhatsApp itself?”

Sukhiba’s platform allows orders to be placed, addresses captured and payments made within the chat, with order data synced back into e-commerce systems like Shopify, WooCommerce and enterprise resource planning (ERP) systems. It also integrates over 30 payment gateways, including Peach Payments, Stitch, Stripe, Flutterwave, and Paystack, so that merchants can offer flexible and localised options.

“We are not necessarily a payment company,” he says. “We are more a payment integrator.”

Andrew Pillay, Sukhiba’s country manager in South Africa, says this strategy fills a significant gap in the local ecosystem.

“We’re far ahead in making sure our technology suits the local market with options and versatility to tailor further.”

However, South Africa has been slow to adapt.

“South Africans are very much a copycat culture, often related to the trust factor,” says Pillay. “We’re still dealing with people asking, ‘Is this safe?’ when a website asks for card details.

“I was with a merchant yesterday, a prominent chain with over 300 branches. They were using a system that was built 20 years ago.”

Regulatory differences also play a role, says Gudipati.

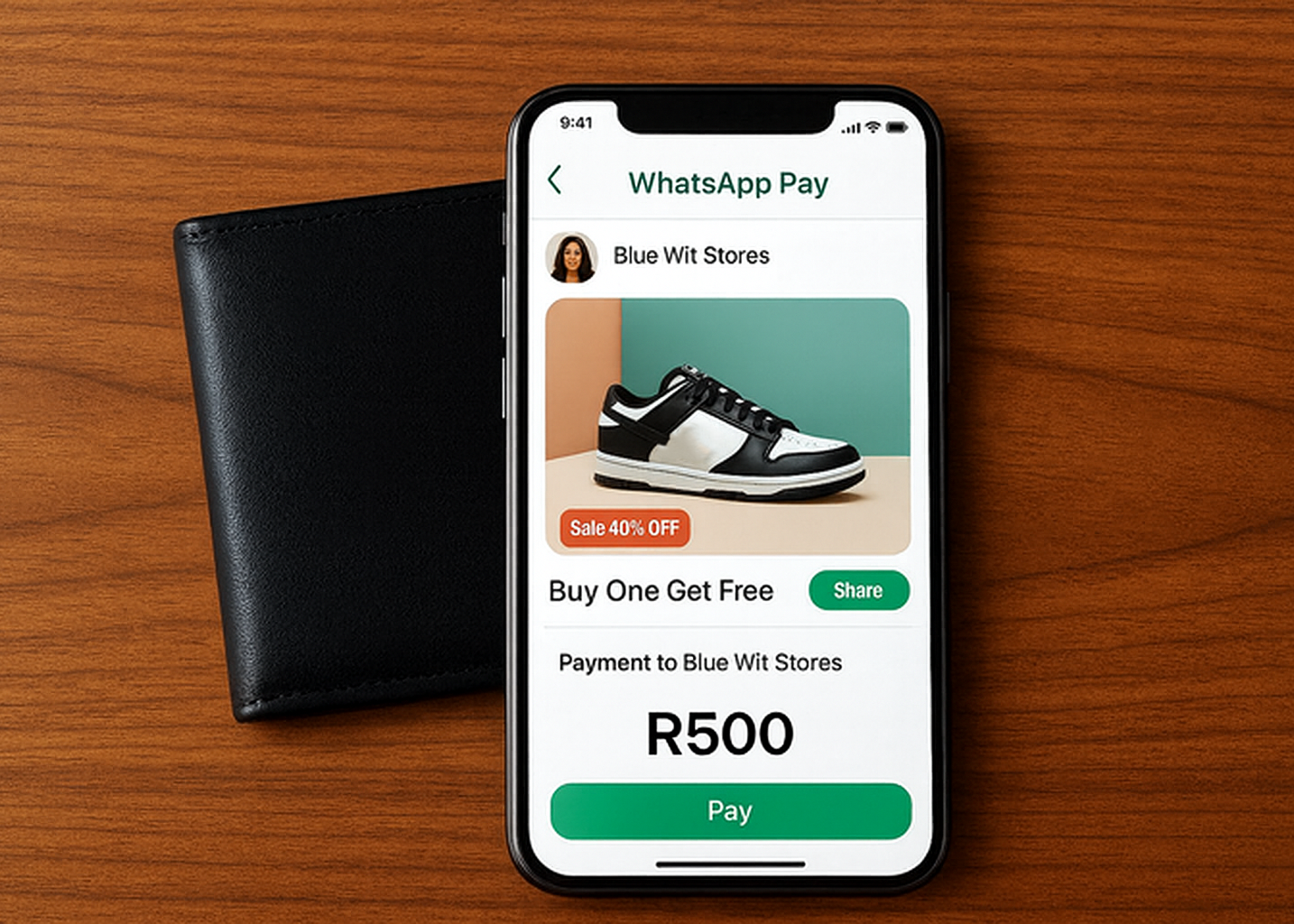

“In India, the payment link is a pop-up inside WhatsApp. It’s a far more seamless experience. In South Africa, that has not yet rolled out.”

Meta is implementing WhatsApp Pay country by country, running pilots to ensure fraud prevention before rolling out deeper commerce layers. The result is an uneven playing field, where emerging markets like India, Singapore and Brazil lead in adoption, while others trail behind. That adoption gap is beginning to close.

“Merchants in Kenya, Nigeria and South Africa are now catching up,” says Gudipati. “They are opening to the fact that they can do a lot more on WhatsApp than pure communication or customer service.”

The future, he says, lies in layering artificial intelligence into this channel.

“All a merchant needs is just a single number. Customers can type ‘I need 10 units of sugar,’ and AI turns it into a cart.”

Sukhiba is already deploying such systems, where returning customers are identified and offered discounts, credit, or tailored promotions based on their behaviour.

The challenge lies in perception.

“Most retailers still think of WhatsApp as an extension of SMS,” says Gudipati. “They spam broadcasts. Customers treat WhatsApp as a private space. You cannot use it as a spam channel.”

Sukhiba insists on opt-in mechanisms, where users choose the services they want. That same trust layer, ironically, has made WhatsApp attractive for commerce.

“WhatsApp has an open rate of 85%. They want to preserve that.”

The challenge is also personal, says Pillay.

“I’m a Famous Brands fan. But I’m super annoyed at having the Steers app, the Fishaways app, the Debonairs app.

“One out of five transactions will use WhatsApp tech within two years. One out of seven will be AI-backed.”

As consumers grow fatigued by app overload and merchants wrestle with digital complexity, WhatsApp offers a paradox: a simple front end backed by sophisticated infrastructure. That’s sure to earn a heart emoji.

* Arthur Goldstuck is CEO of World Wide Worx, editor-in-chief of Gadget.co.za, and author of The Hitchhiker’s Guide to AI – The African Edge.