SA Insights

South Africa drives

region’s music surge

Sub-Saharan Africa’s music industry crosses a milestone as digital innovation reshapes its soundscape, writes ARTHUR GOLDSTUCK.

It was once assumed that Africa would remain on the fringes of the global music economy, exporting talent but never truly commanding its own industry. That notion was firmly silenced last week when the International Federation of the Phonographic Industry (IFPI) released its Global Music Report 2025.

It showed that, in 2024, sub-Saharan Africa’s recorded music revenues passed the $100-million mark for the first time. And South Africa led the charge.

The report revealed a 22.6% rise in revenues in the region, with South Africa contributing a massive 75% of the total. However, the full story lies in the confluence of mobile streaming, local talent, and shifting industry mindsets. The ground has moved under the feet of traditional gatekeepers, and the reverberations are being felt from Johannesburg to Lagos.

Streaming, once a niche luxury, has become the lifeblood of Africa’s music economy. In South Africa, the data usage boom and competitive mobile data pricing, driven by both regulatory pressure and market forces, have created fertile ground for music platforms to thrive. The likes of Spotify, Deezer and Apple Music have become the new radio stations of the digital age.

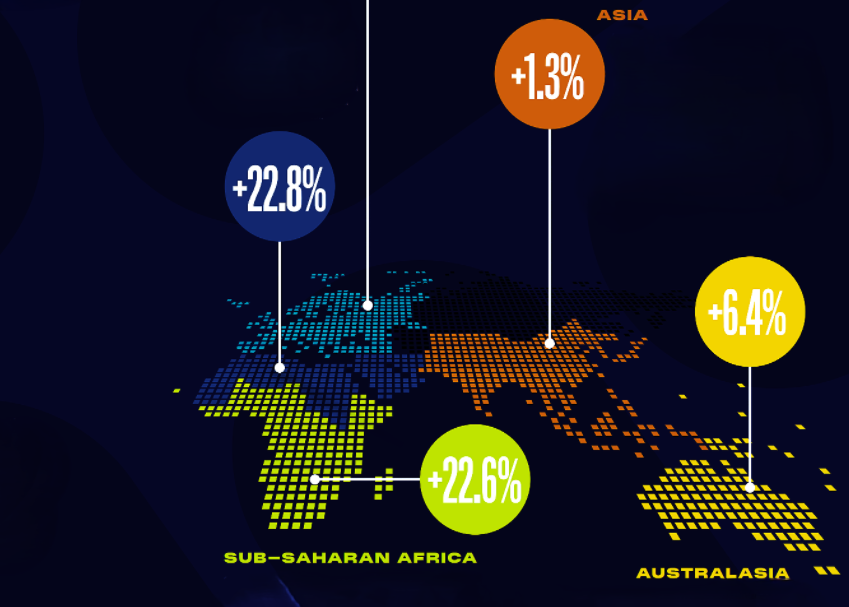

Global recorded music revenues saw a tenth consecutive year of growth in 2024, up 4.8% to US$29.6-billion – with every region experiencing growth. Streaming music worldwide exceeded US$20-billion for the first time, with subscription streaming revenues accounting for over 50% of global recorded music revenues in 2024.

Even vinyl grew once again, with the 18th consecutive year of revenue growth in the format.

The Middle East and North Africa (MENA) was the fastest growing region at a rate of 22.8%, followed by Sub-Saharan Africa (+22.6%) and Latin America (+22.5%). 55 out of 58 markets recorded growth in 2024.

“This growth doesn’t happen by accident,” said IFPI CEO Victoria Oakley in the foreword to the report. “It reflects the brilliant creativity, vision and hard work of artists and songwriters around the globe, powered in part by the work, investment and passion of music companies and their people.

“As the essential partner to artists that wish to develop a long-term and sustainable career in music, record labels find and nurture new talent, unlock new revenue streams and connect artists with audiences by cutting through the huge amount of content being released today, enabling artists to achieve creative and commercial success at every stage of their careers.”

Photo supplied.

Angela Ndambuki, IFPI regional director for sub-Saharan Africa, said in response to the report: ” The continued growth in recorded music revenues in Sub-Saharan Africa is a clear testament to the strategic actions the record companies undertake to create opportunities in the region not only for artists but also for fans of recorded music. The region has over the past few years registered significant growth in digital revenues, especially subscription streaming.

“Without a doubt, technology is an important driver of this success and, therefore, it is crucial for the region to prioritise the improvement in national policies and regulatory environments so as to attract further investment in the wider recorded music business.”

It’s a carefully chosen statement, but it points to a deeper dynamic: this is not a passive boom. It is the result of calculated partnerships, infrastructure investment, and deliberate artist development.

Yet in many African markets, consumers remain price-sensitive. As a result, partnerships between telcos and music services are allowing users to stream music at zero-rated or subsidised data rates. It’s a model that may yet be exported to more developed markets.

Even as digital revenues soar, physical formats continue their slow fade – down globally by 3.1%, despite vinyl’s health. While this format grew by 4.6%, it makes up a tiny portion of the market.

The most seismic undercurrent shaping the future is the rise of AI in music production. The IFPI has expressed growing concern over the unlicensed use of copyrighted material by generative AI tools.

Oakley did not mince words. “AI systems are being trained on music without consent or compensation. We support AI that supports human creativity – but not that which exploits it.”

Beyond the legal frameworks, African genres are finally being embraced not as curiosities, but as central to the global pop conversation. Nigerian Afrobeats artists like Burna Boy and Rema are now mainstays on global charts. South African sounds, particularly Amapiano, are infiltrating playlists in Brazil, the UK, and Japan.

Infrastructure disparities also limit the benefits of the streaming boom. In many townships and rural regions, connectivity remains unreliable and expensive. The ability to stream does not equate to universal access. Here, radio still dominates – and in some ways, that’s a strength. It remains a powerful discovery platform and an opportunity for labels to integrate analogue and digital strategies.

One local artist, asked what success now looks like, responded simply: “It’s when I don’t have to leave South Africa to make it.”

* Arthur Goldstuck is CEO of World Wide Worx and editor-in-chief of Gadget.co.za. Follow him on Bluesky on @art2gee.bsky.social.