Software

SuperPay demos the possibilities of payments

During the Visa CEMEA Security Summit last week, the payments giant showcased the possible future of digital wallets and shopping powered by AI, writes JASON BANNIER.

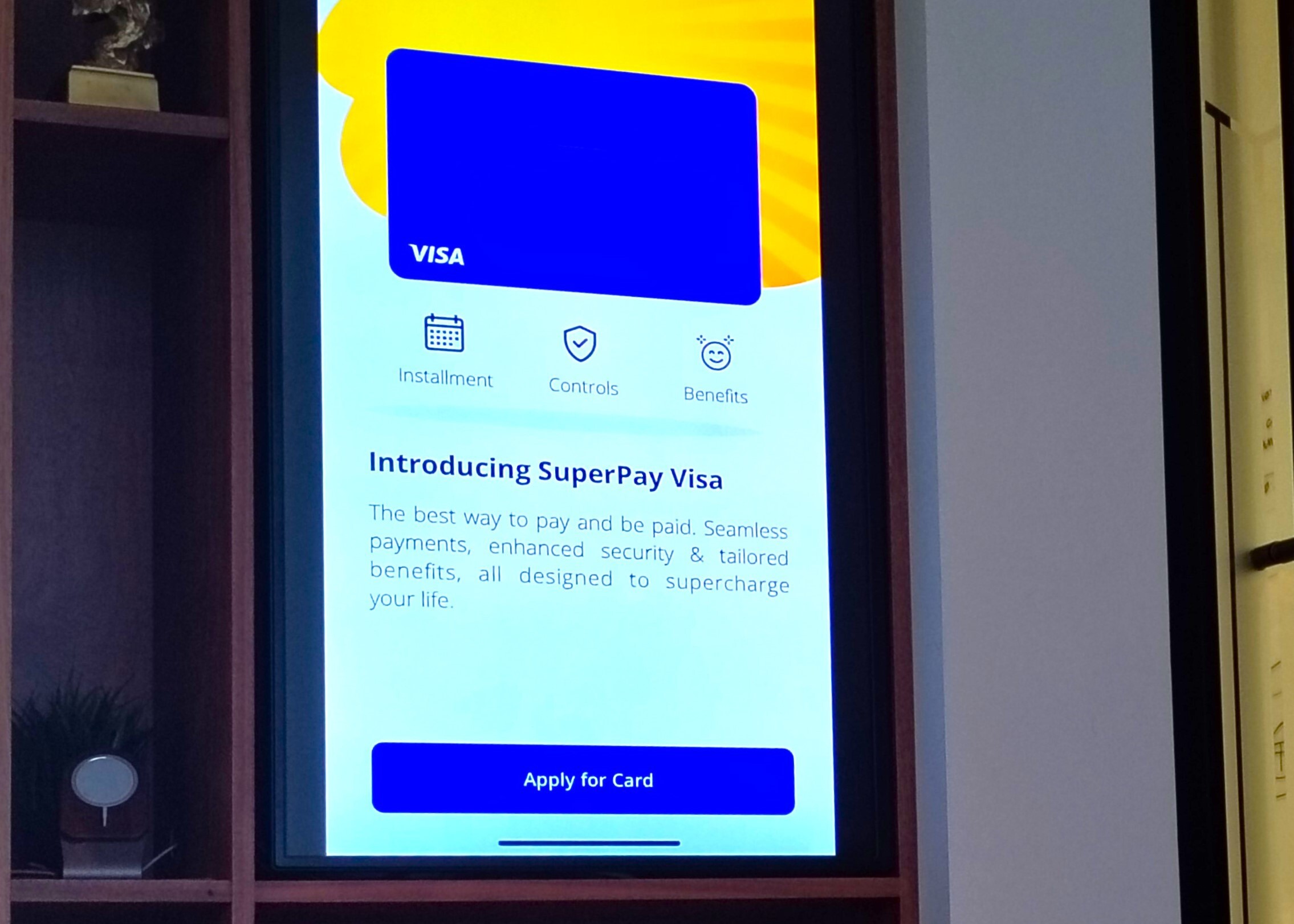

During a media tour of Visa’s Innovation Centre in Dubai last week, the payments giant demonstrated what the future of payments could look like: a “super app”, dubbed SuperPay, an all-in-one application could enable purchases for a variety of items. During these transactions, one would be assisted by a chatbot that uses artificial intelligence (AI), and understands the wants, needs, and financial limitations of yourself as well as your family… if you allow it.

The tour formed part of the Visa Security Summit for Central and Eastern Europe, the Middle East, and Africa (CEMEA). It brought together top Visa executives, industry experts, and thought leaders from around the world to discuss the latest trends and technologies in payment security. The Visa Innovation Centre envisions the future of applications like SuperPay.

“The centre is a demonstration of the art of what is possible,” said Charles Lobo, Visa regional risk officer.

For example, a super app provides multiple services to become an all-encompassing self-contained commerce and communication online platform that embraces many aspects of personal and commercial life.

Several South African companies already provide super apps with some of this functionality. The VodaPay Super App, developed by Vodacom Financial Services in partnership with global digital lifestyle platform Alipay, is described as “an all-encompassing mobile payments solution that has been customised to meet the specific lifestyle and payment needs of consumers, businesses and tech developers”. Nedbank’s Avo super app is a single platform that provides access to grocery delivery, essential services, and household services.

So, imagine an app that reminds you of a family member’s birthday. Well, we have calendars and Facebook for that, right? However, we do not have an app that integrates your financial information and habits in a conversation with you about what your partner would want for their birthday—a personalised gift, catering to their desires and your budget.

Dmitry Dmitriev, Visa senior director for risk strategy and operations, says: “SuperPay is a demonstrative application that illustrates how different organisations that are interested in integrating AI into the consumer experience, and what is possible. Everyone is looking into AI, and Visa has been looking into this technology for the last 30 years.”

Dmitry Dmitriev, senior director, risk strategy & operations at Visa’s Innovation Centre

In this super app, users initiate a conversation with “ShopGPT,” a theoretical AI chatbot. As this chatbot is integrated with payment information and the shared history between you and your partner, it can leverage this data as a reference point. Consequently, ShopGPT can interact with you to help determine an appropriate gift.

Osman Alam, Visa director of innovation and design, says: “AI, like the demonstrative ShopGPT, has become an essential part of everyday life, and we can benefit from it.”

While concepts like ShopGPT may currently be theoretical, the future will see the emergence of real applications of this kind. However, the implementation of apps linking users’ data demands stringent rules and regulations. A robust cybersecurity framework is essential, particularly when third-party applications are involved. The protection of user privacy and the secure handling of sensitive information become paramount considerations in ensuring the responsible and ethical development of such interconnected platforms.

Dmitriev says: “Visa Token Service, a current security technology, replaces one’s card numbers with a unique token that is linked to a device. Visa can identify if a transaction occurs from a different device, and prevent the transaction. This proactive approach allows Visa to detect and prevent transactions from unfamiliar devices, effectively reducing fraud, data breaches, and associated risks in the realm of purchases.”

The hypothetical SuperPay is an established concept, but raises significant data privacy and security concerns. Visa is anticipating future trends and potential challenges with a team of 1,000 cybersecurity specialists to safeguard the integrity of the financial realm. This approach, it says, is essential in addressing the evolving landscape of digital transactions and ensuring the trust and security of users.