Featured

Fintech and EdTech dominate local VC

The latest Venture Capital Industry Survey finds that growth in South Africa’s VC industry remains robust

Share

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Pinterest (Opens in new window)

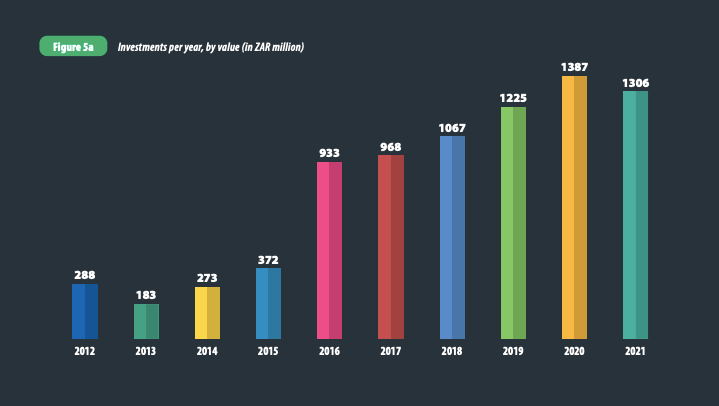

Growth in South Africa’s venture capital (VC) industry is robust, with early-stage fund managers investing R1.31-billion into 121 entities through 186 investment rounds. This is a central finding of the SAVCA 2022 Venture Capital Industry Survey, by the Southern African Venture Capital Association The survey covers equity investments into start-ups and early-stage businesses for the 2021 period.

Stephan Lamprecht says that the findings indicated that two-thirds of all deals were for less than R5-million investment value.

“These results revealed that investment activities in 2021 were fairly similar to those observed in 2020, despite fewer fund managers doing active deals within the survey period,” he says.

The survey reveals that the information and communications technology (ICT) sector accounted for 57% of all VC deals in South Africa during 2021, which corresponds with trends seen in more developed VC markets like the United States and United Kingdom. Together, financial technology (Fintech) and education and training technology (EdTech) deals make up a quarter (25%) of all deals concluded during the year, with FinTech maintaining its dominance amongst investors by attracting the most deals during the period.

The five sectors that attracted the greatest number of deals in 2021 in South Africa were Fintech (15.9%), EdTech (9.1%), Consumer Products and Services (7.9%), ICT – other (7.9%), and Software (6.7%). Together, these amounted to 44.7% of all capital invested in 2021.

Shelley Lotz, SAVCA acting CEO and head of policy and regulatory afffairs, says that both Fintech and EdTech are crucial sub-sectors for South Africa. While the local financial system is highly developed and internationally competitive, financial inclusion remains a pressing challenge.

“Technology advancements in the education sector also offers many benefits, including the opportunity to reach previously underserved segments of society, improve efficiencies, and close skills gaps,” she says.

Fintech also attracted the second largest rand value of investments (R298-million), beaten only by the food and beverage sector, which maintained its leading position from the previous year.

Other notable findings included that Gauteng and the Western Cape remain VC’s preferred investment destinations, with Johannesburg topping Cape Town in receiving the most deals by number in 2021. However, Cape Town remains the base for the biggest pool of companies in the active portfolios of VC fund managers.

The survey also reveals that independent fund managers are responsible for most new deals.

Thiru Pather, investment principal at SA SME Fund, says much needs to be done to stimulate higher levels of fund manager activities in South Africa.

“Firstly, we need to acknowledge that VC is still a developing asset class in our country, especially when compared to more developed countries. As such, the sector needs intervention at all levels for it to truly unlock its potential for economic development. From a macro perspective, more needs to be done to attract institutional investors to the asset class, including banks and pension funds.”

She said that, to attract these institutional investors, the asset class needs to be de-risked.

“This could be achieved by introducing some form of subordinated funding, which will give institutional investors the confidence they need to invest in a more prudent manner by having the requisite downside protection.”

* The survey report can be downloaded here: SAVCA-VC-Survey-2022-Electronic.pdf

Share

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Pinterest (Opens in new window)

| Thank you for Signing Up |