Product of the Day

Absa Pay gets Stitch

in time

New partnership enables Absa, Capitec, and Nedbank direct payments via Stitch’s Pay by Bank Solution.

Payments infrastructure company Stitch has partnered with Absa Bank to offer the newly-launched Absa Pay to its merchants. Stitch will integrate all available direct bank APIs, including Absa Pay, Capitec Pay, and Nedbank Direct API, into its Pay by Bank solution. This integration will allow Absa customers to make payments directly from their Absa accounts to Stitch merchants.

The Pay by Bank method is gaining popularity in South Africa due to its ease of use, speed, and security. Absa’s new API enables customers to make secure payments directly from their bank accounts without entering banking details online.

Junaid Dadan, president of Stitch, said: “It’s exciting to see the continued growth of innovation in South Africa’s banking ecosystem, as Absa brings its API to the market. As infrastructure players, we’re excited to partner with Absa as part of our mission to ensure our clients always have access to the latest payment methods and advancements, such as Absa Pay.

“This will continue to bring more consumers into the digital economy and give them more choice in how they want to make a payment.”

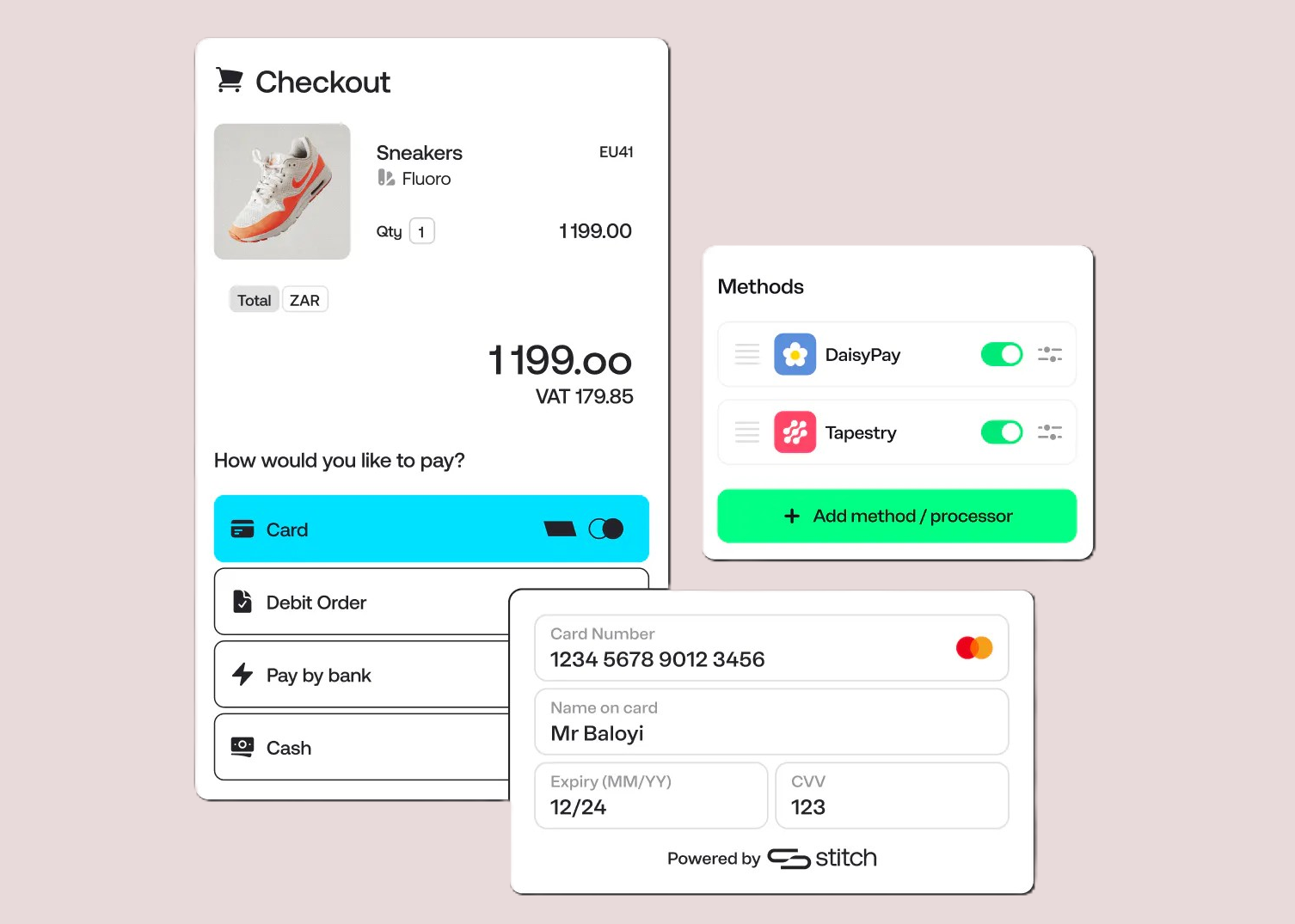

Stitch allows businesses to access bank APIs like Absa Pay without direct bank integration. Existing Stitch clients can add Absa Pay to their current setups without significant development work. New clients can combine Absa Pay with other payment methods through a single integration and manage all payments via the Stitch dashboard.

Stitch, launched in February 2021, has raised $52-million from investors such as Ribbit Capital, PayPal Ventures, and TrueLayer. The company, headquartered in Cape Town, offers a range of payment solutions, including Pay by Bank, Card, Manual EFT, and Cash.